(BISMARCK, ND) – Leaders gathered in Bismarck to highlight the recent Oil and Gas Tax Revenue Study, a collaborative study between the Western Dakota Energy Association and the North Dakota Petroleum Council.

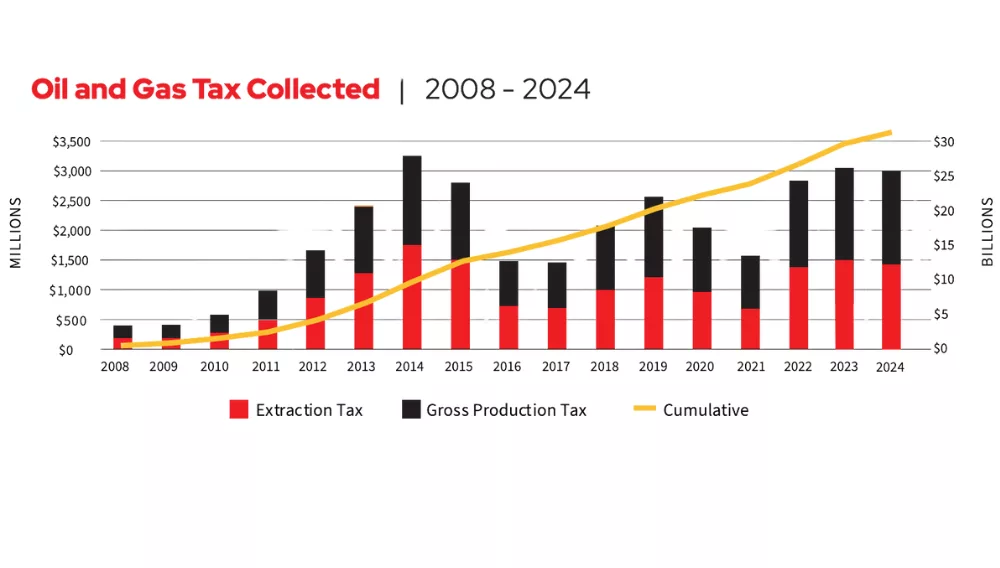

The study, done each biennium, reviews extraction and gross production tax collections in North Dakota, with the latest including fiscal years 2008 to 2024

The study shows that more than $32 billion in financial support to the state has been given since 2028 through the collections.

“All kinds of infrastructure projects, education, public safety, you name it. This has benefited every North Dakotan from a toddler to a senior citizen,” Western Dakota Energy Association Executive Director Geoff Simon said. “Everyone stands to benefit from the oil and gas tax that are collected in the state. So we’re pretty proud of the work that the oil industry does.”

Ron Ness, President of the North Dakota Petroleum Council, laid out the ways the funds benefit North Dakotans.

“This is 32 billion that North Dakotans haven’t had to pay for schools, roads and bridges, water projects, property tax relief is a huge component of all of this we’ve been providing a lot of property tax relief and what I like about it is people have always asked from across western, across North Dakota, what’s in this for me? Why should we support oil and gas? This clearly shows that it’s helping and benefiting every person. person in North Dakota, every student in North Dakota, every family in North Dakota,” he said. “It’s great data. And when you dig into the numbers, you can now see what happens. $1.8 billion to Cass County. My home county of Nelson County, which is a long way from any oil well, $53 million.”