BISMARCK, N.D. – Reports from the North Dakota Tax Commissioner’s Office and the Energy and Environmental Research Center, a nonprofit division of University of North Dakota, forecast what the North Dakota Industrial Commission calls the state’s strategic advantages in leveraging carbon dioxide utilization to drive sustainable energy production, economic growth and environmental benefits over the next 20 years.

The Industrial Commission says federal tax policy provides a $25 per ton advantage for permanent carbon storage over utilization. The reports reveal North Dakota’s tax policies help narrow this gap to less than $10 per ton for carbon dioxide enhanced oil recovery. The reports share the need for the federal government to enact tax parity for carbon dioxide enhanced oil recovery projects to support the development of long-term carbon dioxide markets.

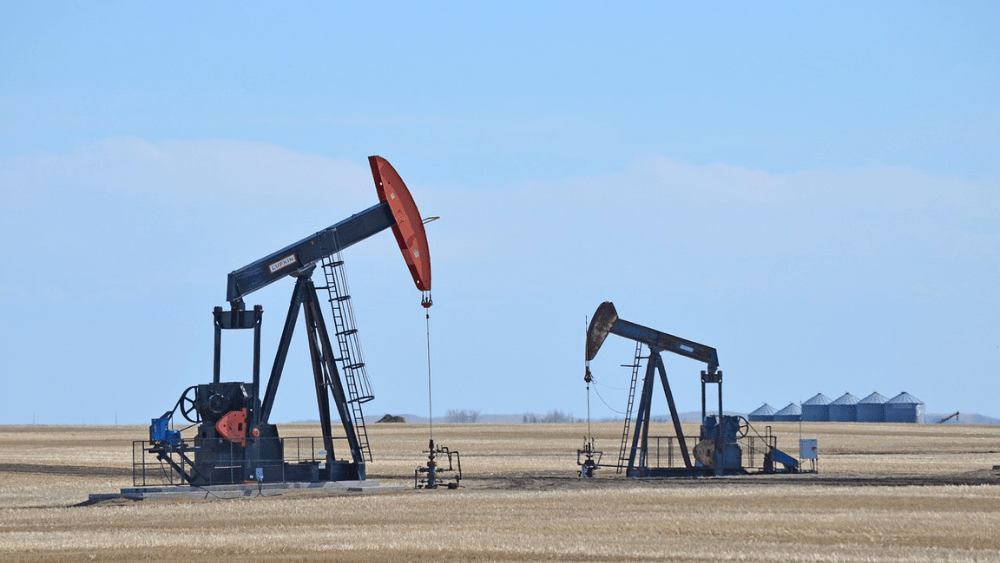

The reports find carbon dioxide enhanced oil recovery could unlock five to eight billion more barrels of oil over the next 30 to 50 years doubling the Bakken’s production. It could also generate $2.9 billion to $9 billion in incremental revenue primarily from oil and gas production tax collected on incremental barrels produced.

“North Dakota continues to lead with innovative policies that support our industries and drive economic growth while addressing the challenges of a sustainable energy future. These reports demonstrate how CO₂-EOR can unlock billions of barrels of untapped oil, reduce emissions and provide billions in revenue – all while maintaining North Dakota’s reputation as a global energy leader,” Governor Kelly Armstrong, Attorney General Drew Wrigley and Agriculture Commissioner Doug Goehring, members of the North Dakota Industrial Commission, said in a joint statement.

Read the report by clicking here.