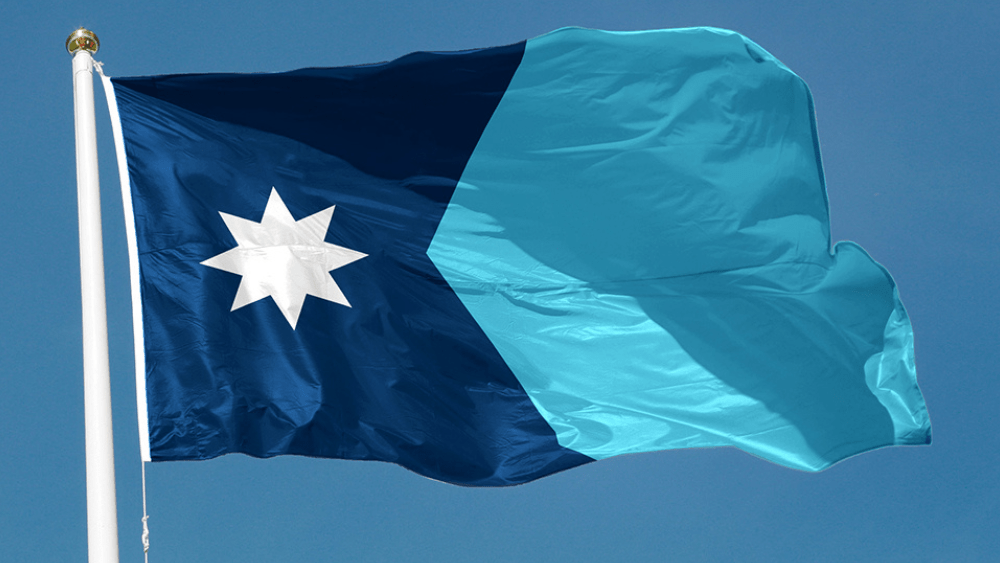

NORTH DAKOTA – A North Dakota State Representative shares why he’s against measure four when it comes to corporations.

Measure four would abolish assessment based property taxes.

“That’s absolutely corporate welfare. They’re going to continue to function and do business in North Dakota and the $1.2 billion that they were contributing from a property tax standpoint every biennium now that responsibility is shifted onto the citizens of North Dakota. I think that’s an amazingly unfair thing to do to our citizens,” Republican State Representative Greg Stemen of Fargo said.

Stemen adds the state only levies one mill on property taxes to support University of North Dakota’s medical center. He believes people should be pressuring their cities, counties, schools and park districts to lower property taxes.

The group End Property Tax ND argues the Legislature could make up for the loss in property tax funding by getting rid of $200 million dollars in legacy fund interest, slashing $600 million in excess revenue over what’s forecasted and cutting $200 million in spending on “corporate welfare” and special interest payouts.