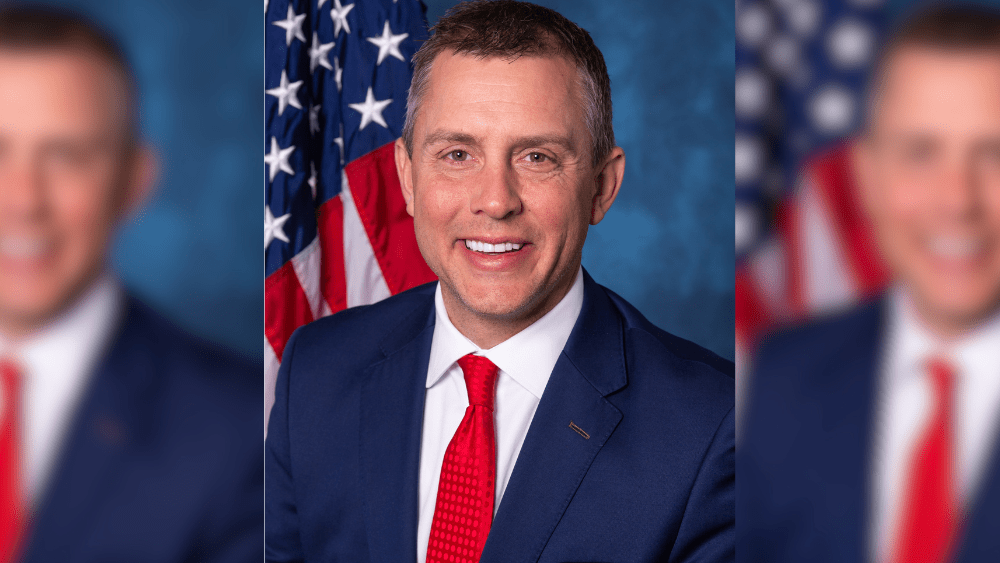

Scott Hennen’s interview with North Dakota Governor Kelly Armstrong

BISMARCK, N.D. – North Dakota Governor Kelly Armstrong says he’s not in favor of giving legacy fund money for property tax relief on agricultural land or commercial buildings.

He says he has a problem with giving that money to out-of-state landowners and businesses.

“I don’t think that’s what the legacy fund is for. Funds are fungible. We deliver a lot on tax breaks on a lot of different things across all sectors of the economy,” Armstrong explained.

The governor adds he’s not sure giving tax relief on agriculture land lowers the cost of that land or to rent it.

Armstrong hopes a bill that would give $1,550 in a primary residence credit and capping local political subdivisions’ spending at three percent of growth will get a hearing in the Senate Appropriations Committee this week. It was supposed to have a hearing on Monday, but a Senator was sick.

Armstrong adds if the state can afford income tax relief, he’d be in favor of looking towards a solution. He says he’s supported every tax break and tax cut since he got into politics in 2012.

“I started this campaign campaigning on income tax and it didn’t take me very many town halls to figure out that’s not what North Dakota voters cared about. I want to prioritize property tax because that’s what I hear about from voters across the state,” Armstrong said.